Setting Goal For Monetary Success

Setting Goal For Monetary Success

Blog Article

When do you believe you should begin planning for your retired life? When you are a couple of months away from retirement? A few years? Now is the best response. Retirement planning is a duty everyone has towards themselves. And let me tell, the earlier you understand this and shake yourselves to do something about it the much better. For those who are currently on their method, give yourself a pat on the back. Being spontaneous is enjoyable, however when it pertains to major phases in life such as retirement you have to get major and take decisions and make strong plans.

Know the ins and outs of the finance market. It is very risky for you to put all your cost savings to a single financial investment. Attempt exploring and dividing your funds into several pursuits. That way, there is minimal danger of getting insolvent even if your investment choice decreased the drain.

The 50-60 age is choosing if they desire to change careers, alter their life goals, or stay in what they are doing right now. They are at that midway place in their lives where they are preparing for their long-lasting goals.

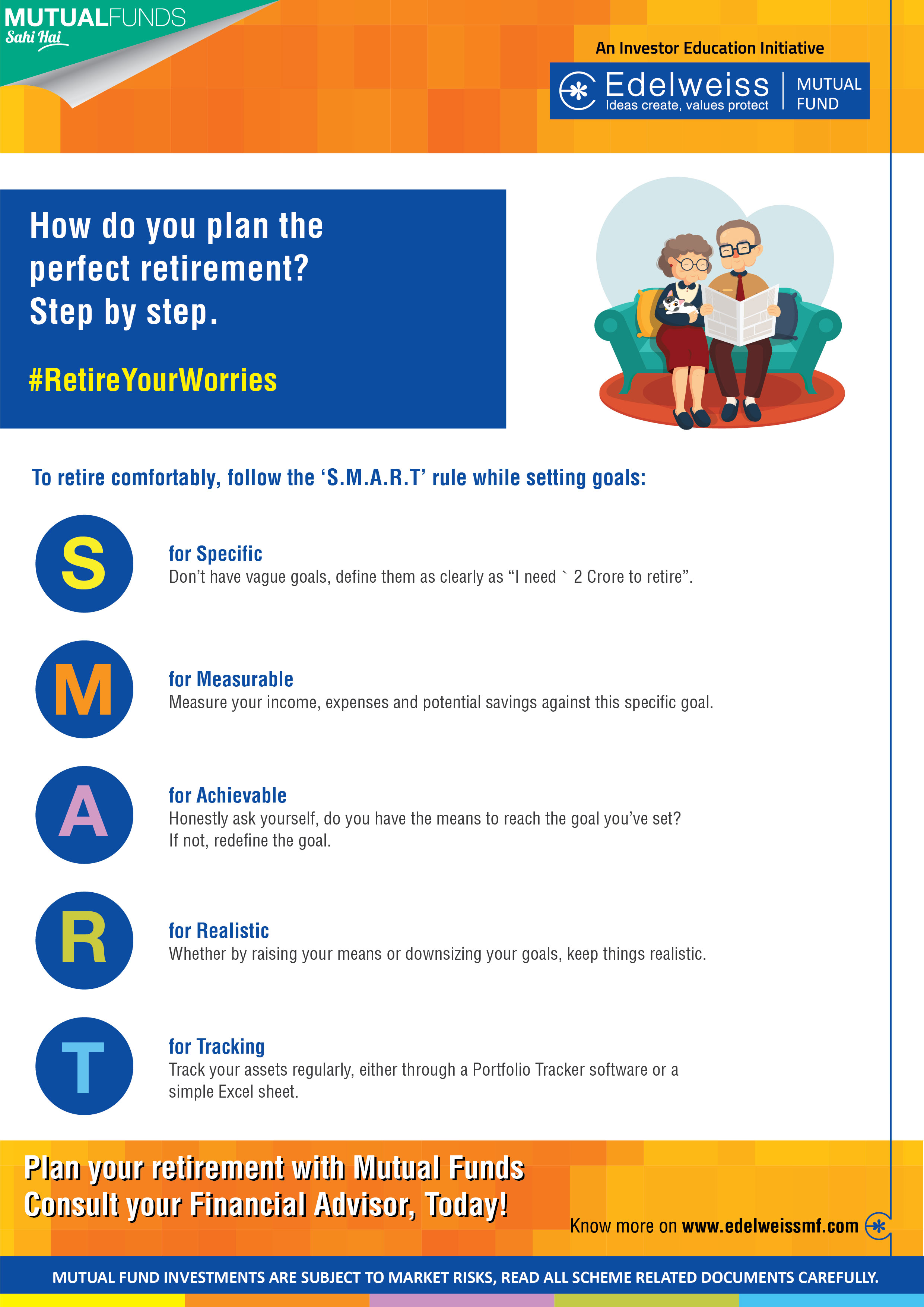

Regardless of your age, where you work or your life circumstance, you need to begin preparing for your retirement as quickly as you can, right away if possible. retirement planning can be argueably more important than saving for a childs college tuititon. They can obtain for college, you can't borrow for retirement expenditures. By starting to plan now, you can take actions towards the retirement earnings you desire and possibly require.

As a young cook in the '80s at Chez Panisse I delighted in the days when I prepared a dish I 'd never ever done before. I would have four hours to turn a concept into something incredible. The stakes were exceptionally high as the restaurant increased to national prominence and the customers included lofty expectations. I discovered the uncertainty exciting. It was a challenge to make each and every meal the very best I perhaps could. We must approach preparing for retirement in the exact same spirit. We desire those years to be remarkable, worthwhile of distinctions. Exactly due to the fact that we can't understand the result of our financial investment techniques with any more certainty than we can anticipate the result of trying a new recipe, we require to dedicate additional effort, energy and attention to our monetary preparation to increase the chances of success.

Quick pointer for this: concentrate on one location, and just one. For circumstances, do not dabble a little in genuine estate investing, stock investing, bonds, etc. Try to select one area and become an expert at that.

Expenditures in Retirement - How much will it cost you to live in today's dollars, retirement activities in retirement? Break down your costs into 3 classifications: requirements, desires, and dreams.

Research other websites with comparable material to see how they handle navigation. You might have the ability to combine specific locations under one button and then break them down in the future in the site. The majority of individuals can quickly deal with about 5 buttons to click on. As you add more than that you are including not just more intricacy to the website but are also running the risk of the stability of the function.